About Keppel

Pacific Oak US REIT

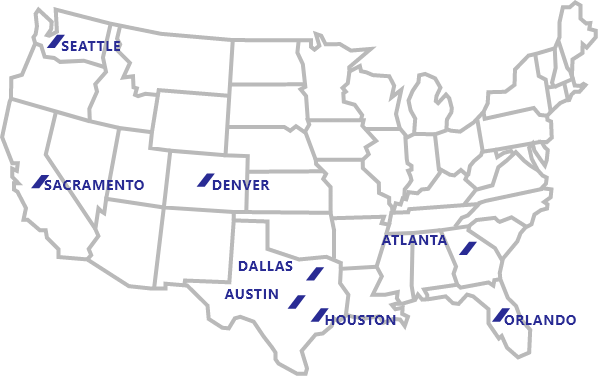

Keppel Pacific Oak US REIT (KORE) is a distinctive office REIT with freehold office buildings and business campuses located across key growth markets driven by innovation and technology in the United States (US). KORE's investment strategy is to principally invest in a diversified portfolio of income-producing commercial assets and real estate-related assets in key growth markets of the US with positive economic and office fundamentals that generally outpace the US national average, and the average of the gateway cities, so as to provide sustainable distributions and strong total returns for Unitholders.